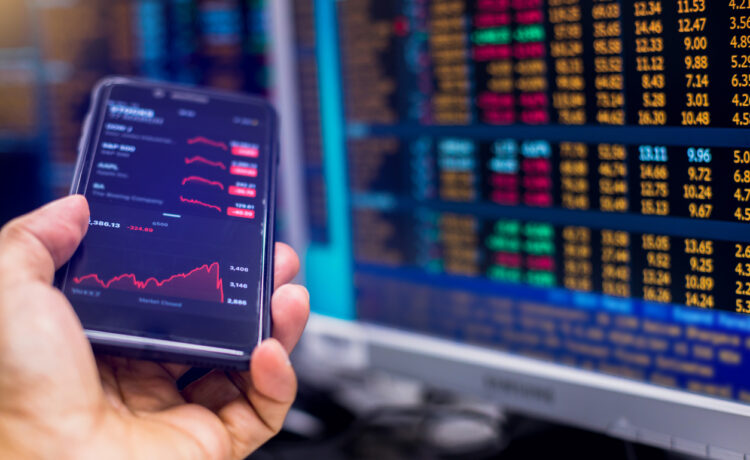

Foreign exchange (or forex trading) is the process of buying and selling currency pairs. There is no central marketplace or exchange where the trading happens. All trades occur digitally over computer networks. Participants in the forex marketplace can trade, purchase, trade, speculate, and sell more than 120+ currency pairs. Forex trading is crucial for trade and business because it makes it possible to purchase goods and services beyond international borders. The forex trading market is composed of businesses, central banks, hedge funds, investment managers companies, small-scale currency dealers. The forex market has more than $6 trillion daily in transactions and is widely considered to be the largest financial sector on the planet.

Best Forex Trading Brokers in 2022 & Their Reviews:

The currency market, which is centralized and open 24/7, is decentralized. It is open Monday to Friday. Participants in forex markets exchange currencies at a predetermined rate. The currency rate changes frequently and is not set in stone. Traders can profit by selling and buying currency pairs based on the price. Before you place your money at stake, you should have a good understanding of forex trading.

There are many currency pairs you can trade in forex. These include Major, Minor, and Exotic currencies. You can choose any currency pair, as they are all categorized by their liquidity. Beginners should limit their trading to one pair per day in order not to be overwhelmed or confused. An important step for beginners is choosing the right currency pairs to trade. The major currencies are the most liquid and widely traded. Easy forecasts and studies can be made. The EUR/USD is the best option for both seasoned and new traders looking to invest in major currency pairs.

Forex assets are considered highly liquid because of the high amount of trade. The majority of foreign currency transactions are made using spot trades. Due to forex trades being leveraged, there are many dangers that can cause significant losses. Forex trading involves substantial risk. It is best to have a thorough knowledge of the market along with a strong sense and control. Many people lose money because they lack self-control. To make a profit while trading forex, you need to invest time and energy learning more about the market.

You may think that forex traders have a very easy life. But they also lose money on average. But there are some who have become wealthy doing trading. The decision is yours as to which side you will support. Refrain from excessive trading and use risk management techniques. Be patient and manage your emotions. For you to succeed on the forex market, you just need the right trading methods. Your life can be transformed with the right knowledge and experience. This may be difficult at times. Remember that you can prevent future losses by focusing on assessing your risk. Also, you should learn from your failures to improve your strategy.